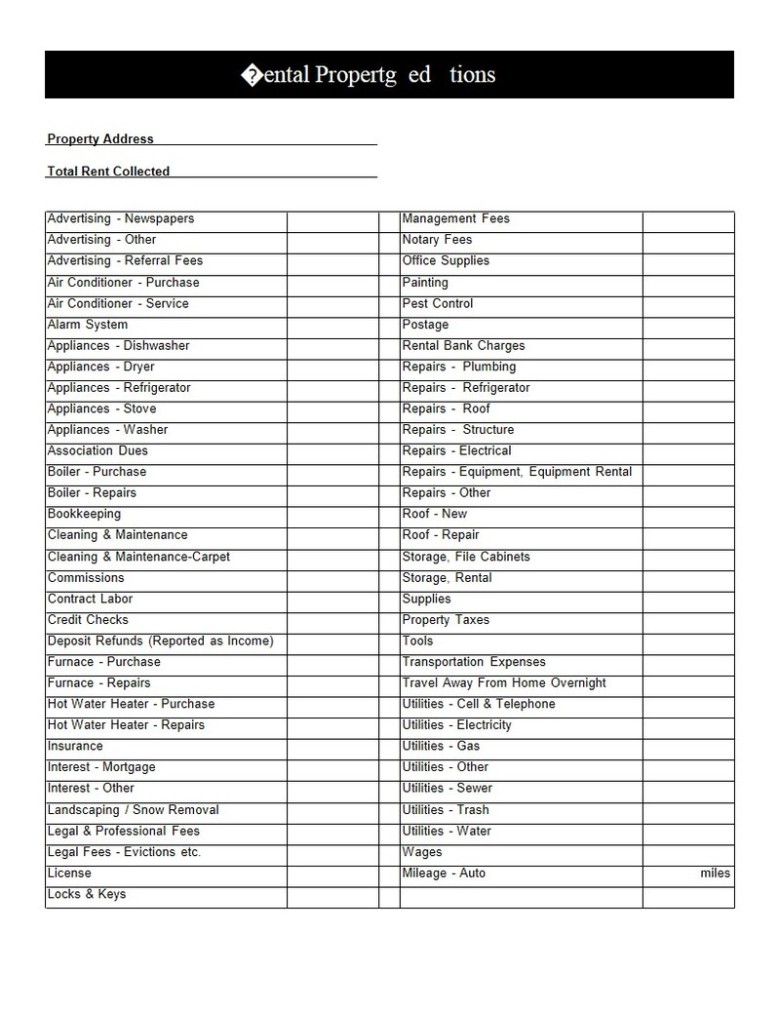

In 2019, people earning more than $200,000 accounted for a higher percentage of all federal individual income tax paid than their share of all income received. Tax exemptions and credits, on the other hand, tend to provide more benefits to lower-income earners 2.įigure (1) displays the progressivity by comparing the share of income earned by individuals in that income bracket with the share of federal individual income taxes paid. How do tax policies affect individuals? Income RedistributionĪmerica has a progressive individual income tax: The higher your income, the higher your tax rate. The brief is a companion piece to SIEPR’s 2022 Fall Policy Forum on Taxation. Rather, it highlights some of the trade-offs that policymakers face when deciding whether to raise or lower taxes and details on exemptions, credits, and other subsidies. This brief is not meant to be an exhaustive discussion of federal individual and corporate taxation. We use examples from major tax reforms in recent decades, including the Tax Reform Act of 1986 (“TRA86”) and the Tax Cut and Jobs Act of 2017 (“TCJA”), to discuss some of the motivations and consequences of tax reforms. This policy brief reviews the implications of some tax policies on the behaviors of individuals and businesses, focusing primarily on the federal income tax. Taxation also affects how entrepreneurs organize their businesses, how much to borrow and invest, and where they locate the businesses they create.

Changes in the tax codes influence the decisions people make about whether and how much to work, how much to save for retirement, and where to live. Tax policies affect the type and amount of income subject to taxation and the rate at which it is taxed. tax revenue accounted for about a quarter of the country’s GDP 1.

Stanford Environmental and Energy Policy Analysis Center (SEEPAC).Stanford Center on China's Economy and Institutions (SCCEI).California Policy Research Initiative (CAPRI).

0 kommentar(er)

0 kommentar(er)